how to open tax file in bangladesh

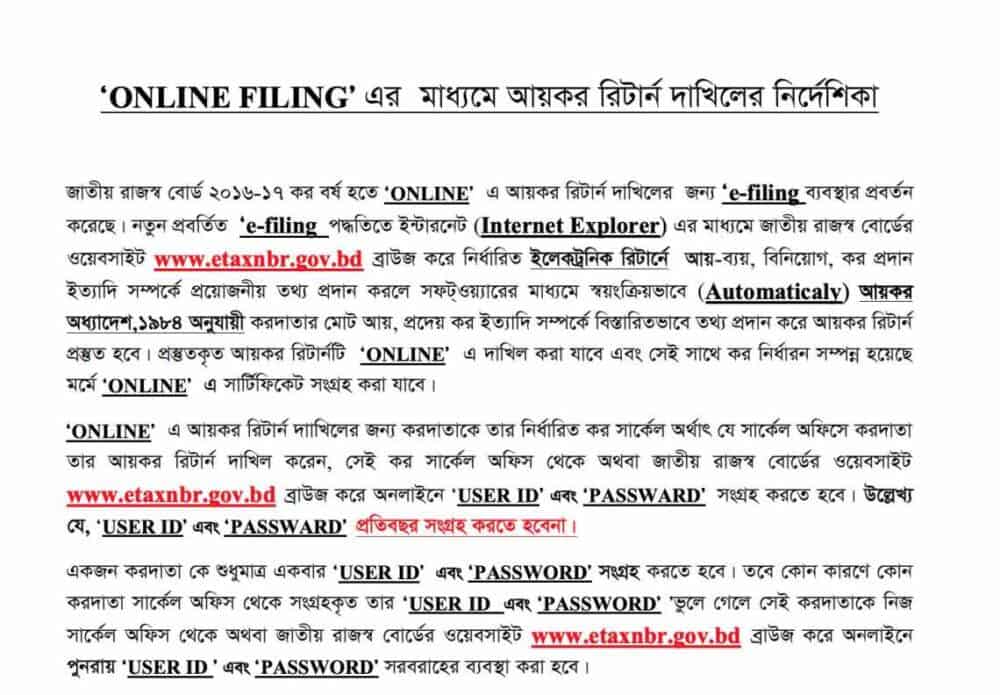

Tax return filing and tax payment relief measures COVID-19 Bangladesh. First you have to click on the Registrar button then you have to register with the User ID Password Security Question Email Address and Mobile Number.

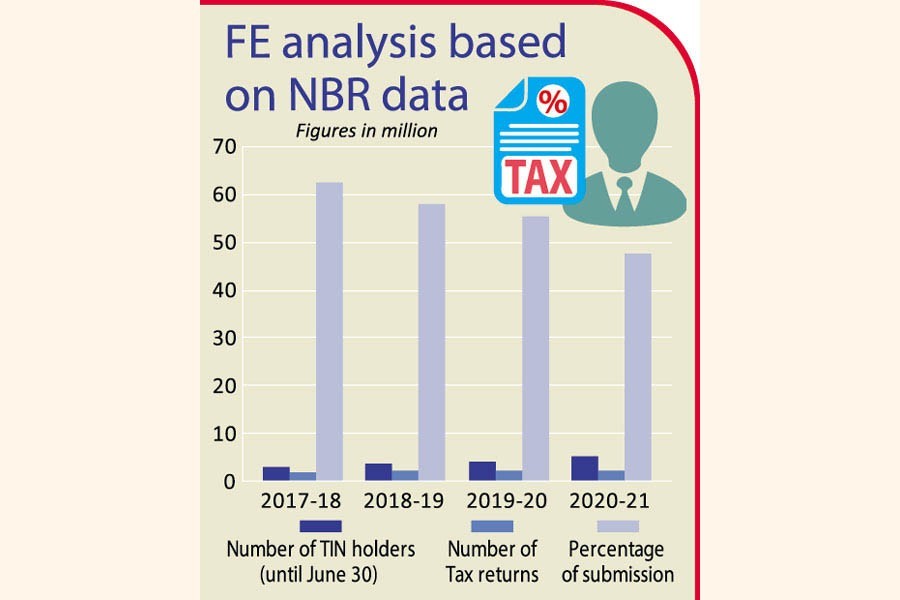

Majority Tin Holders Didn T Submit Tax Returns Nbr May Get Tough On Them

Certificate of tax collected at source Doc Certificate of tax collected at source Pdf Certificate of tax deducted at source Doc Certificate of tax deducted at source Pdf Monthly Statement of Tax Deduction from Salaries Pdf.

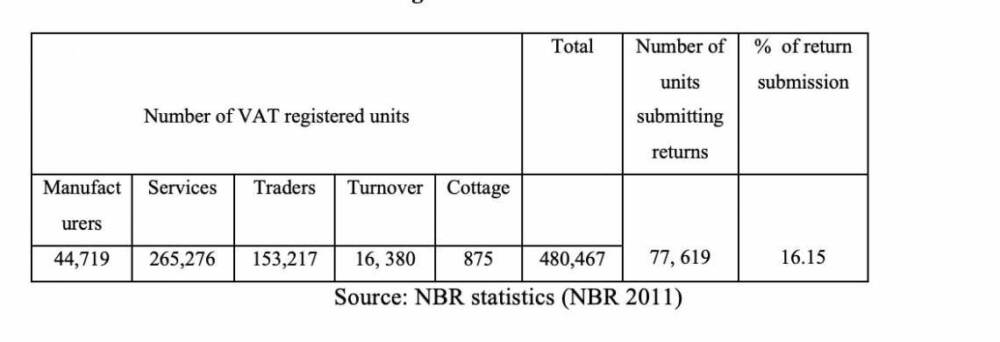

. Primary Information of Assesses. Value-added tax VAT is levied on the importation of goods and the making of taxable supplies in the course of carrying out a taxable activity. The system displays an online.

Any non government organization registered with NGO Affairs bureau. Return-Business Professional income upto 3 Lakh- IT11CHA. Turnover Tax applicable to turnover tax payer up to Taka 8 million is 3.

Obligation to file tax return. The government earns by levying tax on the income generated by the population. Our taxation services at FM Consulting International ensure both advantage to the individual and compliance according to Bangladesh taxation policy.

The following is a step by step guidelines on the individual income tax return filing in Bangladesh. Register as a taxpayer. At First Visit the Website.

Configuring Mozilla Firefox and Interner Explorer for Submitting Online Income Tax Return in Bangladesh using Adobe Acrobat Reader DCLatest Adobe Acrobat Re. Income expenses assets and liabilities related documents are required to prepare tax return and then filing tax return to the tax circle. Choose the online account application form and clicks the link Click here.

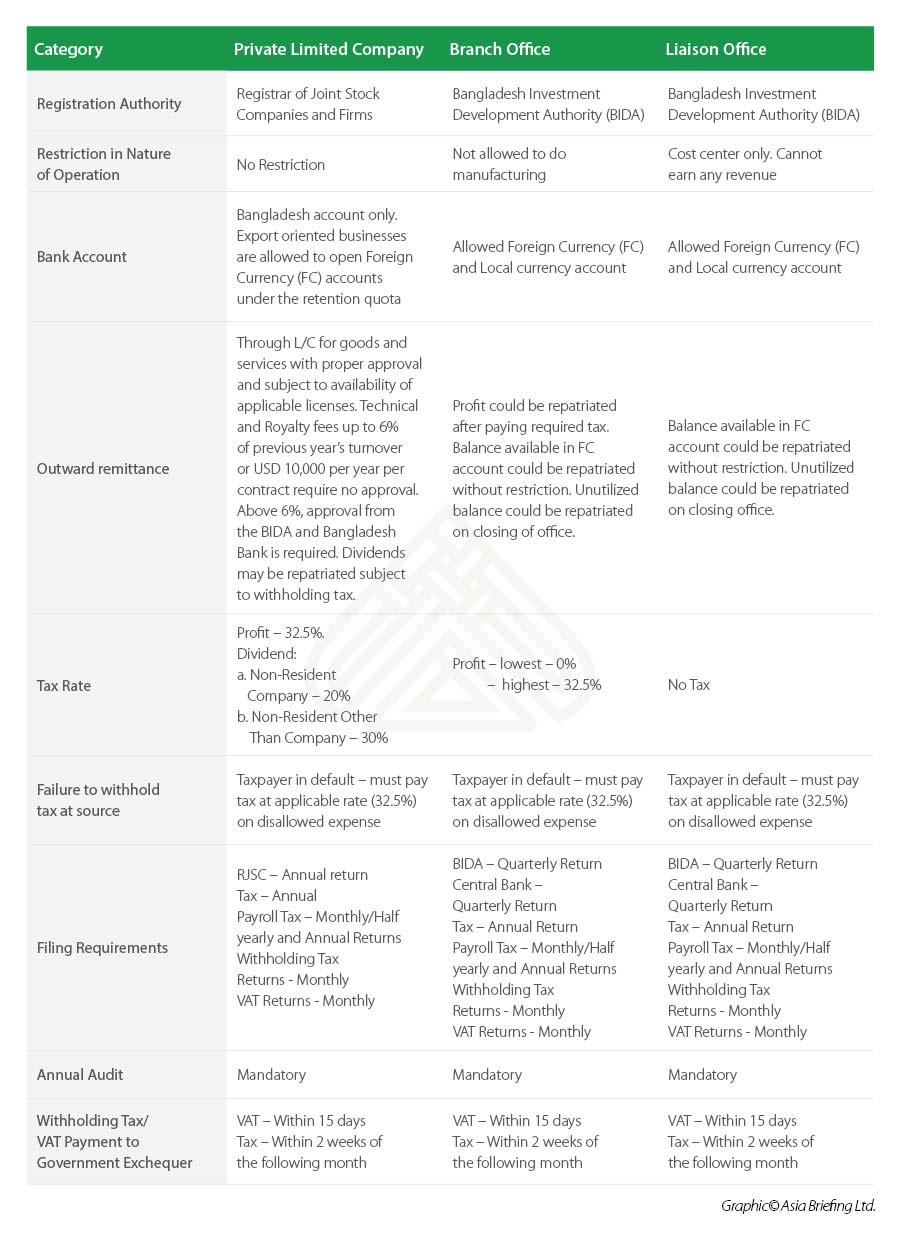

You can calculate yo. Time limit to submit the return and supporting documents. A branch company shall withhold tax at the rate of 20 while remitting profit to Head Office.

In order to verify a persons status of income. Exchequer by pay order challan treasury or. Time limit to submit the return.

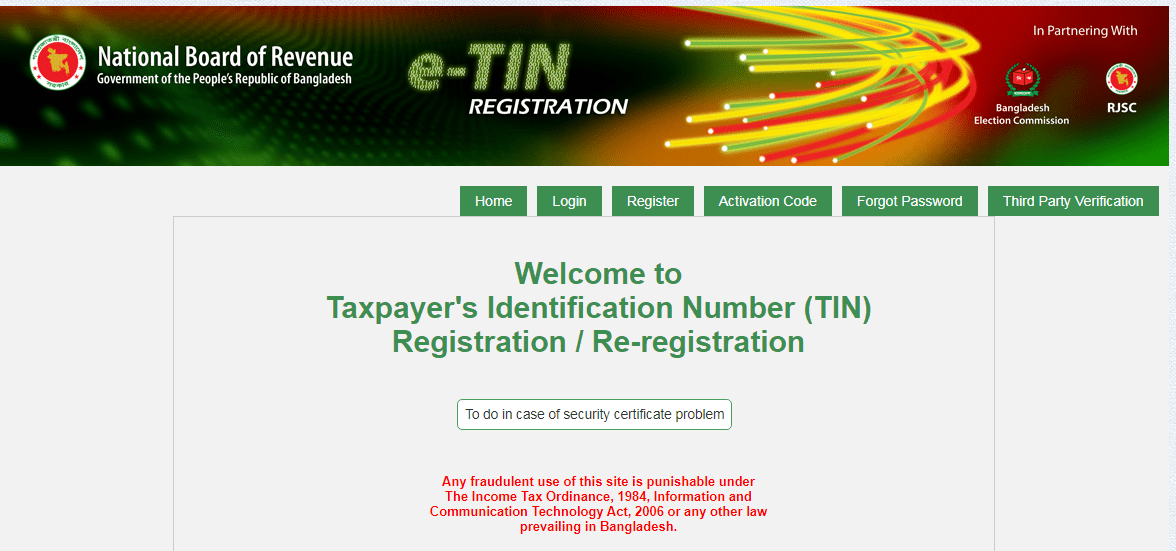

The followings are the steps one needs to follow to obtain TIN certificates in Bangladesh since the process is digitalised lots of hassle and time has been saved. Now people of Bangladesh can open their eTIN account. From 01 July 2021 submission of return of.

An overview of Individual Income Tax in Bangladesh. If you are a withholding agent update your source tax deposit. For Tax Submission in Bangladesh each assessee shall deposit the amount to the govt after assessing the amount of income tax.

In this video I will show Income from house property Income tax return filing 2020-21 in Bangladesh how to file house property income. Update your tax payment. The standard rate is 15 percent.

It has one of the largest In 880 17 11 314156. Tax return filing and tax payment relief. File your tax return.

Income tax in Bangladesh can range from 0 to 30 percent and you need to be sure you are placed in the correct tax brackets. Every individual must submit hisher income tax return to the concerned Deputy Commissioner DC of Taxes from 1 July to 30 November. A person shall file a return of income to the DCT of the income year.

The government on 7 May. Required Document for Submission of TAX RETURN Document Needed for Submission of TAX RETURN. 250000 during the income year then that person needs to file.

The rates of Tax applicable in Bangladesh are as follows. However in cases where dividend is payable to a shareholder resident in a country with which. Pictures for the first time.

Exchequer through pay order treasury challan or online via wwwnbrepaymentgovbd and. A if the total income of the person during the income year exceeds the minimum tax threshold under this. The National Bureau of Revenue NBR of Bangladesh has fastened the process of registering for E-Tin in Bangladesh.

A countrys great source of income is its population. After assessing the amount of income tax every assessee shall deposit the amount to the govt. As per the requirement stated in the Finance Act 2017 if any person earned more than Tk.

Pay your tax online. An individual must file tax return within 30th. Income Tax BD an Income Tax Consultancy service provider in Bangladesh Since 2011.

The standard rate of VAT in Bangladesh is 15. If you are a contractor and want a calculation on. From the homepage Taxpayer clicks Register Account tab.

New Income Tax Rule To Hit The Middle Earners Hard

10 Companies Responsible For 40 Of Total Vat In Fy21 Dhaka Tribune

How To Submit Taxes In Bangladesh Income Tax Customs Duties Vat

Online E Tin Registration And Income Tax Return 2021 22

Income Tax Return Filing To Be Mandatory For All Tin Holders

Online E Tin Registration And Income Tax Return 2021 22

How To Collect E Tin Certificate From Online In Bd Only 5 Minutes

How To Submit Taxes In Bangladesh Income Tax Customs Duties Vat

Pdf Taxation Of Bangladesh Kazi Arafat Munna Academia Edu

How To Submit Taxes In Bangladesh Income Tax Customs Duties Vat

How To Submit Taxes In Bangladesh Income Tax Customs Duties Vat

How To Submit Taxes In Bangladesh Income Tax Customs Duties Vat

Online Tax Return Application Digitax Launched

How To Submit Taxes In Bangladesh Income Tax Customs Duties Vat

Vat Return Tutorial How To Submit Mushak 9 1 Vatcons Bd Part 1 Youtube

Starting A Business In Bangladesh Common Legal Entity Options